Summary:

- The “Genius” Idea: A “stablecoin” called $UST that was supposed to be worth $1.00. But it wasn’t backed by dollars… it was backed by code and a sister token, $LUNA.

- The Bait: A “savings protocol” called Anchor that magically paid 20% interest (APY) on this $UST stablecoin. This was the “magic money” that created a massive, artificial demand.

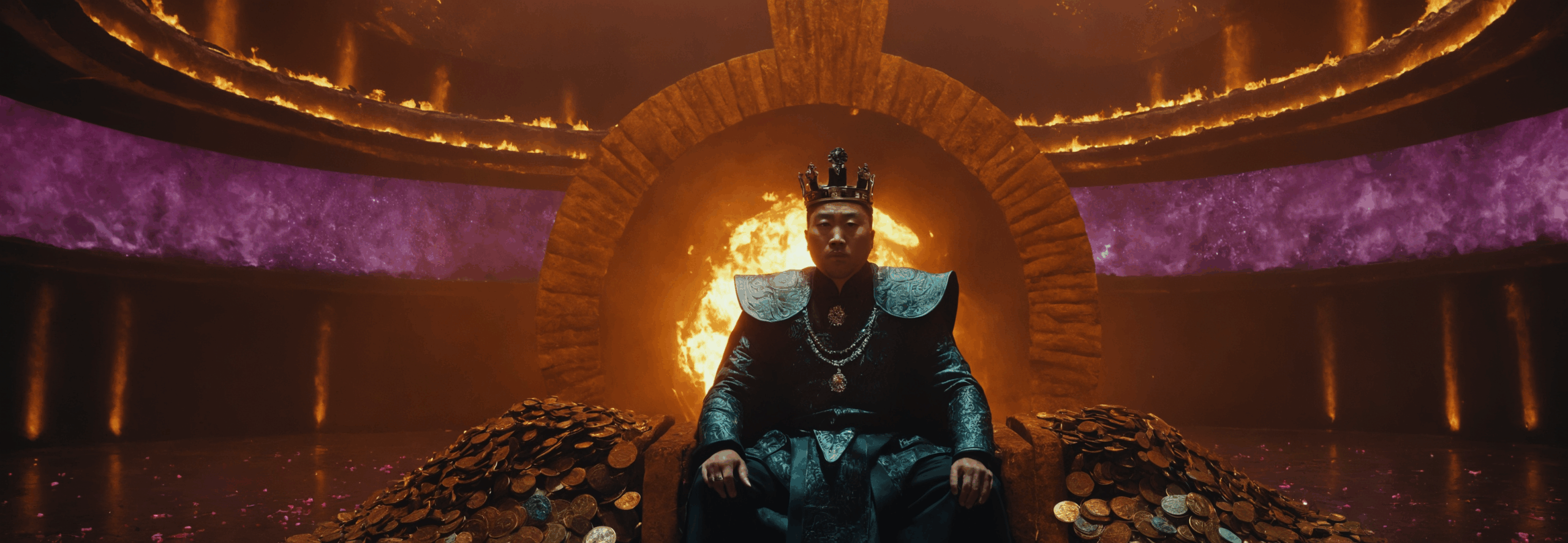

- The Arrogant King: The project’s founder, Do Kwon, who taunted critics, called people “poor,” and famously tweeted, “I don’t debate the poor.”

- The “De-Peg”: In May 2022, $UST slipped from $1.00 to $0.98. Panicked users rushed for the exits, all at the same time.

- The Death Spiral: The “genius” code turned into a hyper-inflationary doomsday machine. In 72 hours, $40 billion in value was wiped out. $LUNA went from $80 to $0.0001.

The Cult of the “Lunatics”

In 2021, a new crypto-empire was rising, and its king was Do Kwon. He was brilliant, charismatic, and fatally arrogant. His project, Terra, wasn’t just another crypto; it was a new financial system.

The system had two tokens:

- $UST (TerraUSD): An algorithmic stablecoin. This was the “money.” It promised to always be worth $1.00, but it had no dollars, gold, or bonds in a vault. Its peg was maintained purely by a “genius” algorithm.

- $LUNA (Terra): The sister token. This was the collateral, the “stock” in the empire. It had a volatile price.

Here was the magic trick: You could always swap $1.00 worth of $LUNA for 1 $UST token, and vice-versa.

If $UST ever fell to $0.99, traders could “buy” the cheap $UST and swap it for $1.00 worth of $LUNA, making a risk-free cent. This arbitrage, in theory, would push the price of $UST back to $1.00. It was a perfectly balanced machine… or so everyone thought.

The Bait: The 20% “Magic Money” Machine

How do you get billions of people to buy your new magic stablecoin? You build the most irresistible bait in crypto history: The Anchor Protocol.

Anchor was a “savings” app. You deposit your $UST, and it paid you a fixed 20% annual interest.

Think about that. The bank gives you 0.1%. Stocks give you 7%. But Anchor gave you 20% on a “stable” dollar. It was the “magic money tree.” Billions of dollars poured in. Everyone from college kids to giant crypto funds staked their money, all convinced they’d found the secret to infinite wealth. The followers called themselves “Lunatics.”

The Attack and “The De-Peg”

For a year, Do Kwon taunted his critics. When economists warned that a 20% yield from nowhere was a “Ponzi scheme,” he laughed at them. When people said the “algo” peg was fragile, he said, “I don’t debate the poor.”

Then, on May 7, 2022, the machine broke.

A few massive, coordinated trades (some say a deliberate “attack”) hit the market. A “whale” sold hundreds of millions of $UST at once. This was more selling than the arbitrage bots could handle.

The price of $UST slipped to $0.98.

In a normal, sane market, this was a blip. But this wasn’t a sane market. It was a cult built on a 20% magic money tree. The spell broke.

The 72-Hour Death Spiral

Panic.

Everyone with money in Anchor rushed for the exit at once. They all tried to use the “genius” algorithm to get their money out.

- “I want to redeem my 1 $UST (now worth $0.95) for $1.00 worth of $LUNA!”

- The system, following its rules, had to obey. It started printing billions of new $LUNA tokens to pay everyone.

- This massive new supply of $LUNA flooded the market. The price of $LUNA started to crash.

- As $LUNA’s price fell, people realized the collateral backing $UST was becoming worthless.

- This caused more panic. $UST holders, now desperate, tried to sell for any price. $UST fell to $0.60, then $0.30.

- But every time someone redeemed their $UST, the system had to print even more $LUNA.

It was the “death spiral” critics had warned about. The “genius” mechanism was a doomsday machine.

- $LUNA price fell.

- …Which forced more $LUNA to be printed.

- …Which made the $LUNA price fall faster.

- …Which forced even more $LUNA to be printed.

In 48 hours, the $LUNA supply went from 350 million tokens to 6.5 TRILLION tokens.

The price of $LUNA, which had been $80, fell to $0.01. Then $0.0001. Then it was delisted. $UST, the “stablecoin,” fell to 1 cent.

In 72 hours, $40 billion of value was gone. Life savings, vanished. The king, Do Kwon, went from a crypto god to an international fugitive. The great “Lunatic” empire was nothing but digital dust. It was the single greatest (and fastest) collapse in financial history, and it set off a chain reaction that would topple the rest of the crypto industry just months later.